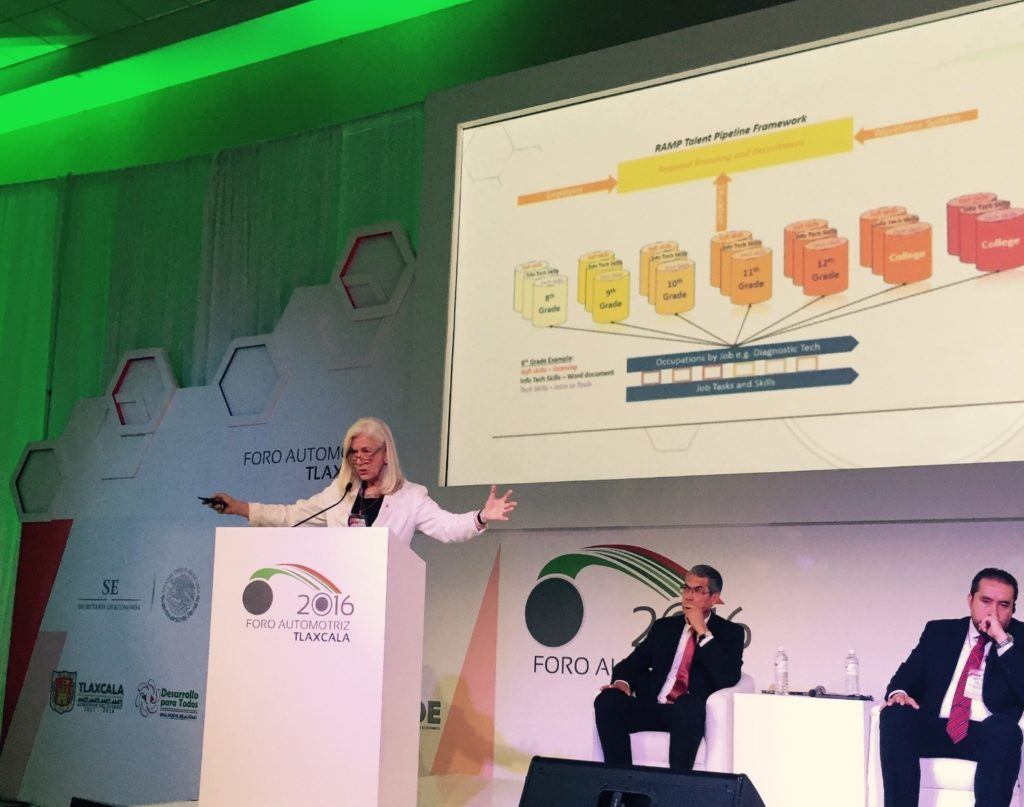

On September 1st, CSW Senior Fellow, Burke Murphy traveled to Tlaxcala, MX as a guest of the state, where she gave a presentation on regional competitiveness and clusterization. The Governor and Ministry of Tourism and Economic Development hosted a forum on the automotive industry cluster, which is a key driver of the economy of the state and the neighboring state of Puebla. Notably, Volkswagen has been headquartered in Puebla for over 60 years and employs 13,000 workers, in addition to a vast supply chain.

What are clusters?

By definition clusters are geographic concentrations of interconnected companies and institutions in a particular field. Clusters are a means not an end and they are also not the same as a cluster strategy. Implementing a cluster strategy provides a method for understanding regional assets, organizing and coordinating across the public and private sectors, and engaging employers and higher education institutions (HEIs) to strengthen their regional talent pipeline. As an economic development practice, clusterization provides a framework for organizing and engaging a region; to analyze its economic strengths and weaknesses; and be strategic about education, workforce and economic development investments.

Challenges and Opportunities

Concerns expressed by Mexican companies, government and HEIs at the forum included significant challenges, but also key opportunities

- lack of trust

- stopping the export of intellectual capital

On the upside…

- shift from production to design

- move towards an added value economy

A key operational and occupational demand within the export driven automotive industry is advanced logistics services and supply chain management. Both speakers on Logistics and the Supply Chain for the Automotive industry, Peter Koltai, Director of Logistics for Audi Mexico and Rafael Lopez Marquez, Director of Logistics, Ford Motor Company, emphasized the new demand required in advanced logistics services – being ready to manage complexity. Both articulated that competitiveness depends on inventory and the total cost of logistics, with a supplier base projected to increase by 20% or more in the next 5 years.

EXAMPLE 1

The Audi plant is designed to produce 150,000 vehicles a year, with long term employment reaching 3,000 – 4,000. Currently 1,500 employees are involved in the new training center, with 600 Mexican employees sent to Germany to learn the “DNA of Audi and the German language.”

Why are advanced logistic services required? The plant will produce the luxury Q5 SUV where each individual customer can order “a package,” making no two Audis the same! Production is scheduled to begin in second half of 2017, and will require advanced logistics services. Learn more about Audi Logistics HERE.

EXAMPLE 2

Ford Motor Company has been in Mexico for 90 years, with six operational sites currently. Over the past 10 years Ford has seen significant changes in the 25 exporting economies that are affecting their logistics and supply chain management. Rafael Lopez, Director of Logistics, stated that Ford sees opportunity in Mexico in part due to the stable economy and quality of manufacturing. In 2015, Ford produced 434,000 vehicles and 590,000 engines, and exported almost as many. Ford spent $11.5 million dollars for Mexican suppliers to provide parts to Mexico and the United States.

Ford’s forecast for 2020 – Mexico will show the 3rd highest growth globally in automotive production – almost 49% in the next 5-6 years! Supply chain optimization is a priority, therefore they will utilize key performance indicators, continuous improvement strategies and supply chain security measures. Ford has created certification programs for transferability between Mexico, the United States and Canada.

Next Steps Needed

To combat lack of trust and stop the loss of intellectual capital, forming strategic partnerships between government, employers and educators will be key. Coming together to deliver relevant training for the specialized occupations in demand will play a significant role in producing the labor force needed.

Building a talent pipeline focused on advanced logistics and supply chain optimization will strengthen the competitive advantage of Tlaxcala. Relevant training begins by convening industry employers with education in order to target the skills and occupations in demand, which then can be aligned with programs offered at the Technical Schools and Universities. Along with an existing strategic advantage in location, Tlaxcala has integrated the German Schools’ dual education methods, and two Technical Institutes already offer Logistics Programs.

Curbing the loss of intellectual capital requires policy interventions that support living wages for all workers, at all levels – an ongoing issue for Mexican workers. Mexico’s automotive workers may be recognized as a quality labor force, but it is also a low cost labor force. Much has been said about the emerging middle class in Mexico, but is this automotive industry building a middle class for Mexico the way it did the United States? Many Mexicans would prefer to stay in their homeland with family and friends, but the lack of equity in wages still drives workers north of the border for better opportunities.

For more information on clusters or to learn about industry in Mexico, contact Burke Murphy @ bmurphy@skilledwork.org and watch a short video of the event HERE!

Comments are closed.